Minnesota Property Tax Refund Homeowner . you may qualify for a property tax refund if you are/were: The refund provides property tax relief. if you're a minnesota homeowner or renter, you may qualify for a property tax refund. if you're a homeowner or renter in ramsey county, you may qualify for one or more property tax refunds from the state of. both homeowners and renters are eligible to claim a refund. If you're still unsure about the status of your return, call. Plus, homeowners may be eligible for a special property tax refund. Married, separated, or divorced during the year; if you’re a minnesota homeowner or renter, you may qualify for the state’s homestead credit refund and renter’s property tax. the minnesota homestead credit refund can provide relief to homeowners paying property taxes. minnesota offers property tax relief to both homeowners and renters.

from www.formsbank.com

you may qualify for a property tax refund if you are/were: both homeowners and renters are eligible to claim a refund. The refund provides property tax relief. if you're a homeowner or renter in ramsey county, you may qualify for one or more property tax refunds from the state of. minnesota offers property tax relief to both homeowners and renters. If you're still unsure about the status of your return, call. Plus, homeowners may be eligible for a special property tax refund. if you're a minnesota homeowner or renter, you may qualify for a property tax refund. the minnesota homestead credit refund can provide relief to homeowners paying property taxes. if you’re a minnesota homeowner or renter, you may qualify for the state’s homestead credit refund and renter’s property tax.

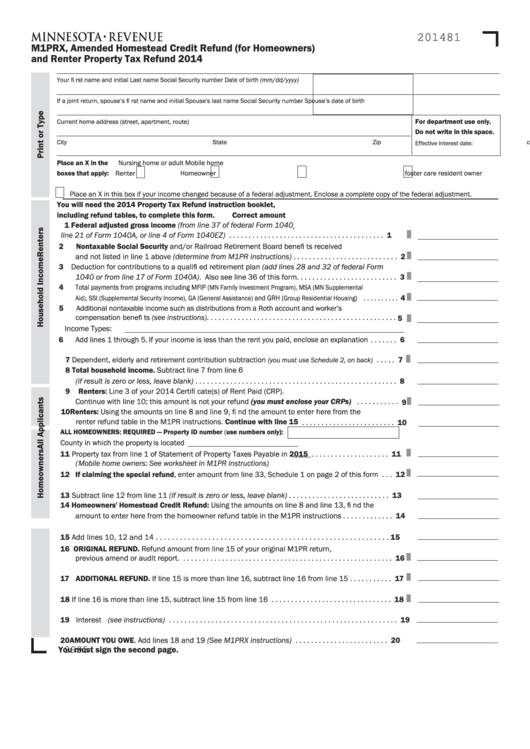

Fillable Form M1prx Minnesota Amended Homestead Credit Refund (For

Minnesota Property Tax Refund Homeowner you may qualify for a property tax refund if you are/were: the minnesota homestead credit refund can provide relief to homeowners paying property taxes. if you're a minnesota homeowner or renter, you may qualify for a property tax refund. minnesota offers property tax relief to both homeowners and renters. both homeowners and renters are eligible to claim a refund. you may qualify for a property tax refund if you are/were: Married, separated, or divorced during the year; Plus, homeowners may be eligible for a special property tax refund. If you're still unsure about the status of your return, call. The refund provides property tax relief. if you're a homeowner or renter in ramsey county, you may qualify for one or more property tax refunds from the state of. if you’re a minnesota homeowner or renter, you may qualify for the state’s homestead credit refund and renter’s property tax.

From tooyul.blogspot.com

2013 Minnesota Property Tax Refund Instructions Tooyul Adventure Minnesota Property Tax Refund Homeowner The refund provides property tax relief. Plus, homeowners may be eligible for a special property tax refund. both homeowners and renters are eligible to claim a refund. the minnesota homestead credit refund can provide relief to homeowners paying property taxes. if you’re a minnesota homeowner or renter, you may qualify for the state’s homestead credit refund and. Minnesota Property Tax Refund Homeowner.

From www.propertyrebate.net

Minnesota Property Tax Refund Fill Out And Sign Printable PDF Minnesota Property Tax Refund Homeowner if you're a minnesota homeowner or renter, you may qualify for a property tax refund. The refund provides property tax relief. If you're still unsure about the status of your return, call. if you're a homeowner or renter in ramsey county, you may qualify for one or more property tax refunds from the state of. Married, separated, or. Minnesota Property Tax Refund Homeowner.

From www.taxuni.com

How to Check Minnesota Property Tax Refund Status? Minnesota Property Tax Refund Homeowner The refund provides property tax relief. both homeowners and renters are eligible to claim a refund. If you're still unsure about the status of your return, call. you may qualify for a property tax refund if you are/were: Married, separated, or divorced during the year; minnesota offers property tax relief to both homeowners and renters. if. Minnesota Property Tax Refund Homeowner.

From brookeqbernelle.pages.dev

Mn Property Tax Refund Form 2024 Sonya Sharon Minnesota Property Tax Refund Homeowner if you're a minnesota homeowner or renter, you may qualify for a property tax refund. the minnesota homestead credit refund can provide relief to homeowners paying property taxes. The refund provides property tax relief. if you’re a minnesota homeowner or renter, you may qualify for the state’s homestead credit refund and renter’s property tax. If you're still. Minnesota Property Tax Refund Homeowner.

From wjon.com

Additional Property Tax Refund Available for MN Homeowners Minnesota Property Tax Refund Homeowner both homeowners and renters are eligible to claim a refund. The refund provides property tax relief. Married, separated, or divorced during the year; if you're a minnesota homeowner or renter, you may qualify for a property tax refund. if you’re a minnesota homeowner or renter, you may qualify for the state’s homestead credit refund and renter’s property. Minnesota Property Tax Refund Homeowner.

From nwhomepartners.org

Don't Your Minnesota Property Tax Refund NeighborWorks Home Minnesota Property Tax Refund Homeowner Married, separated, or divorced during the year; if you're a minnesota homeowner or renter, you may qualify for a property tax refund. if you’re a minnesota homeowner or renter, you may qualify for the state’s homestead credit refund and renter’s property tax. Plus, homeowners may be eligible for a special property tax refund. the minnesota homestead credit. Minnesota Property Tax Refund Homeowner.

From www.signnow.com

Mn Property Tax Refund 20222024 Form Fill Out and Sign Printable PDF Minnesota Property Tax Refund Homeowner If you're still unsure about the status of your return, call. the minnesota homestead credit refund can provide relief to homeowners paying property taxes. The refund provides property tax relief. you may qualify for a property tax refund if you are/were: both homeowners and renters are eligible to claim a refund. minnesota offers property tax relief. Minnesota Property Tax Refund Homeowner.

From www.formsbank.com

Fillable Form M1prx Minnesota Amended Homestead Credit Refund (For Minnesota Property Tax Refund Homeowner you may qualify for a property tax refund if you are/were: minnesota offers property tax relief to both homeowners and renters. both homeowners and renters are eligible to claim a refund. Plus, homeowners may be eligible for a special property tax refund. If you're still unsure about the status of your return, call. if you’re a. Minnesota Property Tax Refund Homeowner.

From krwc1360.com

MN Dept. of Revenue Reminds Homeowners and Renters to File for Property Minnesota Property Tax Refund Homeowner minnesota offers property tax relief to both homeowners and renters. both homeowners and renters are eligible to claim a refund. Married, separated, or divorced during the year; if you're a homeowner or renter in ramsey county, you may qualify for one or more property tax refunds from the state of. the minnesota homestead credit refund can. Minnesota Property Tax Refund Homeowner.

From quietletitbit.weebly.com

Download free How To File Property Tax Refund In Mn quietletitbit Minnesota Property Tax Refund Homeowner you may qualify for a property tax refund if you are/were: the minnesota homestead credit refund can provide relief to homeowners paying property taxes. both homeowners and renters are eligible to claim a refund. Married, separated, or divorced during the year; if you're a minnesota homeowner or renter, you may qualify for a property tax refund.. Minnesota Property Tax Refund Homeowner.

From dxoekatex.blob.core.windows.net

Who Is Eligible For A Property Tax Refund In Minnesota at King Williams Minnesota Property Tax Refund Homeowner if you’re a minnesota homeowner or renter, you may qualify for the state’s homestead credit refund and renter’s property tax. both homeowners and renters are eligible to claim a refund. the minnesota homestead credit refund can provide relief to homeowners paying property taxes. if you're a homeowner or renter in ramsey county, you may qualify for. Minnesota Property Tax Refund Homeowner.

From www.taxuni.com

How to Check Minnesota Property Tax Refund Status? Minnesota Property Tax Refund Homeowner you may qualify for a property tax refund if you are/were: if you're a homeowner or renter in ramsey county, you may qualify for one or more property tax refunds from the state of. if you’re a minnesota homeowner or renter, you may qualify for the state’s homestead credit refund and renter’s property tax. both homeowners. Minnesota Property Tax Refund Homeowner.

From www.threads.net

House Democrats are committed to growing Minnesota’s middle class and Minnesota Property Tax Refund Homeowner If you're still unsure about the status of your return, call. if you're a homeowner or renter in ramsey county, you may qualify for one or more property tax refunds from the state of. Married, separated, or divorced during the year; both homeowners and renters are eligible to claim a refund. if you’re a minnesota homeowner or. Minnesota Property Tax Refund Homeowner.

From www.templateroller.com

Form M1EDA Download Fillable PDF or Fill Online Assignment of Minnesota Property Tax Refund Homeowner if you're a minnesota homeowner or renter, you may qualify for a property tax refund. both homeowners and renters are eligible to claim a refund. the minnesota homestead credit refund can provide relief to homeowners paying property taxes. Plus, homeowners may be eligible for a special property tax refund. if you’re a minnesota homeowner or renter,. Minnesota Property Tax Refund Homeowner.

From www.youtube.com

Who is eligible for Minnesota property tax refund? YouTube Minnesota Property Tax Refund Homeowner If you're still unsure about the status of your return, call. both homeowners and renters are eligible to claim a refund. you may qualify for a property tax refund if you are/were: The refund provides property tax relief. if you're a minnesota homeowner or renter, you may qualify for a property tax refund. minnesota offers property. Minnesota Property Tax Refund Homeowner.

From www.pdffiller.com

Fillable Online Homeowner's Homestead Credit RefundMinnesota Department Minnesota Property Tax Refund Homeowner if you're a minnesota homeowner or renter, you may qualify for a property tax refund. The refund provides property tax relief. the minnesota homestead credit refund can provide relief to homeowners paying property taxes. if you're a homeowner or renter in ramsey county, you may qualify for one or more property tax refunds from the state of.. Minnesota Property Tax Refund Homeowner.

From brookeqbernelle.pages.dev

Mn Property Tax Refund Form 2024 Sonya Sharon Minnesota Property Tax Refund Homeowner If you're still unsure about the status of your return, call. the minnesota homestead credit refund can provide relief to homeowners paying property taxes. if you're a homeowner or renter in ramsey county, you may qualify for one or more property tax refunds from the state of. both homeowners and renters are eligible to claim a refund.. Minnesota Property Tax Refund Homeowner.

From www.taxuni.com

Minnesota Homestead Credit Refund 2023 2024 Minnesota Property Tax Refund Homeowner If you're still unsure about the status of your return, call. if you're a minnesota homeowner or renter, you may qualify for a property tax refund. The refund provides property tax relief. Married, separated, or divorced during the year; the minnesota homestead credit refund can provide relief to homeowners paying property taxes. Plus, homeowners may be eligible for. Minnesota Property Tax Refund Homeowner.